Do fund managers and business angels take Environmental, Social and Governance (ESG) considerations into account when making investment decisions ? The answer is yes, according to the results of a research project carried out by Master students from SDA Bocconi and supervised by the European Investment Fund (EIF).

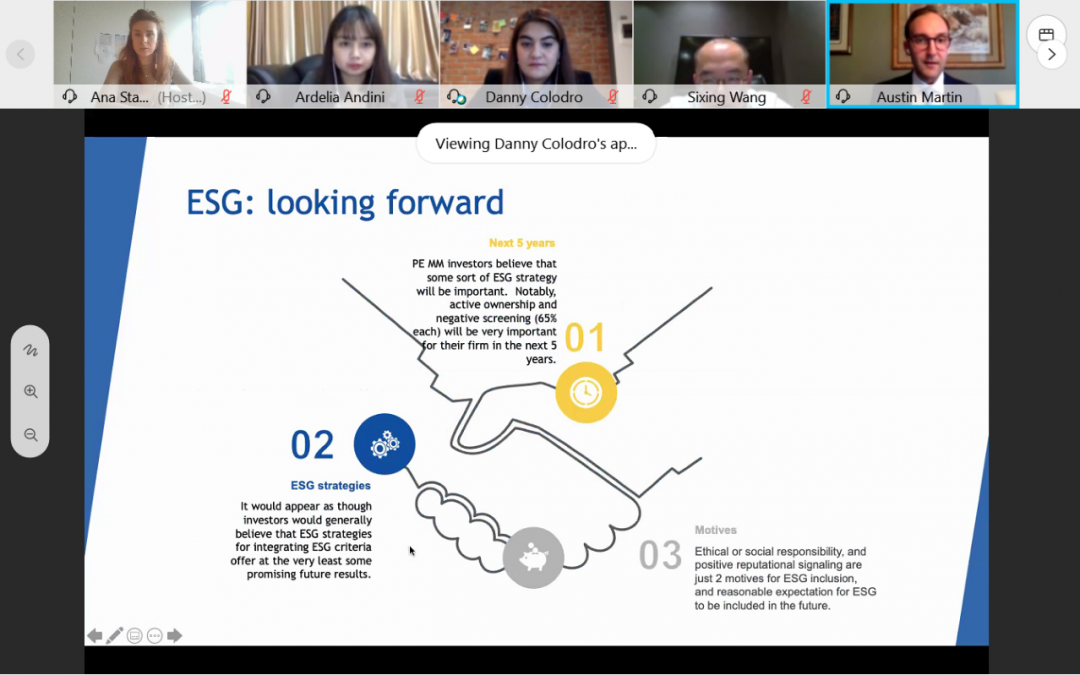

Based on three pan-European Surveys conducted by the EIF earlier in 2020, the results, presented on 10 November, provided testimony on the integration of ESG considerations into the investment process of Venture Capitalists (VC) and Private Equity (PE) mid-market fund managers, as well as of business angels. Results showed that:

- A majority of respondents do take into account ESG considerations for at least some of their investments

- ESG information predominantly serves as a portfolio screening tool

- Approximately half of the VC and PE mid-market fund managers monitor and measure the ESG performance of their portfolio companies, but the related information tends to be disclosed only to their investors

- Qualitative information and internal frameworks/methodologies are the most cited methods used to measure ESG performance, pointing to the need for a more standardised and commonly accepted framework for this purpose

- The surveys also covered the area of impact investing and found that the vast majority of impact investors aim at delivering market returns and perceive a natural correlation between impact and the financial returns they seek in their investments

- The availability of high quality investment opportunities and the availability of professionals with relevant skill sets are the two most important challenges in implementing a sound impact investing strategy.

A full results report will be published by the EIF’s Research & Market Analysis. The ESG survey results of the 2019 EIF Surveys have been published in the EIF’s Working Paper Series, WP No 63. The project was performed as a fellowship under the EIB Institute capstone framework.